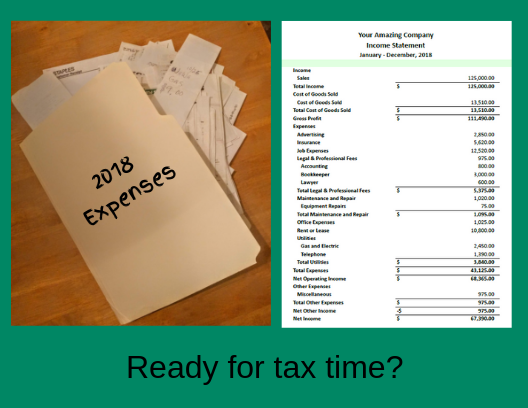

- Less stress at tax time. How much did you earn this year? How much of that was reimbursement for expenses and not really “income”? What are your total expenses for the year? Instead of scrambling to add up your income and expenses from old check stubs and faded receipts, you’ll be able to see all your income and expenses at a glance in an Income Statement.

- Increased insight into your business. Do you know who your most profitable customers are? What is the average time it takes to get paid for the work you’ve done? Are there steps you can take to get paid faster? What are your biggest expenses? How much are you spending with each of your vendors? Can you leverage your spending with a particular vendor in order to earn a discount? Accurate bookkeeping will allow you to understand how money flows into and out of your business so you can make sound financial decisions.

- Keep up with your financials all year long – not just at tax time. No one starts a business just to experience the joys of tax time! Why did you start your business? What are the fun things you’re planning to do with your profits? Before you decide how much money to take out of the business for personal use, it’s important to consider your Balance Sheet. This statement will tell you not only how much money you have in your business bank account, but also how much you currently owe and how much equity you have in the business. You can use this information to determine if it’s the right time to start having fun or if you need to keep the cash in the business for a little longer.

- Peace of Mind. How much are you making this month? Is it more or less than last month? What are your expenses for the month? Are you earning more than you’re spending? Having answers to these questions wards off the stress that comes with uncertainty. If the answers are not what they should be, you can make a plan to correct things.