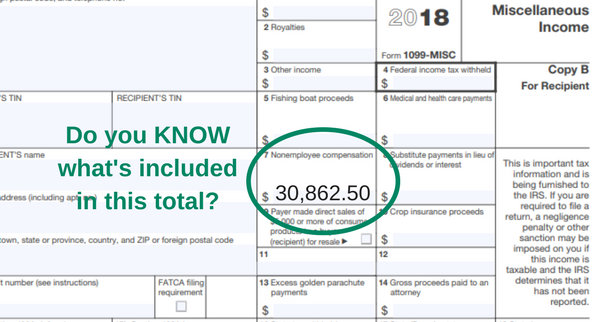

Just a quick reminder to independent contractors who haven’t filed tax returns yet … Make sure you understand the amounts being reported in Box 7 of your 1099-MISC. Businesses you contract with may or may not include your reimbursed expenses in this box. If reimbursed expenses are not included, then you don’t deduct those expenses on your tax return since you were already reimbursed for them. If, however, the reimbursements are included in the total amount reported in Box 7, then you should deduct those expenses on your tax return. (In my experience, including these reimbursements on the 1099 is more common than not including them.) Hopefully you’ve kept good records and can tell what’s included in the reported amount by comparing it to your own records. If you’re not sure, though, it’s a good idea to call the issuer of the 1099-MISC and ask what is included in the total.

Another issue that may come up is that the amount reported on the 1099-MISC is higher than the actual amount of income you received. In some cases, this may be because the issuer includes a payment that was issued prior to the end of the year, but that you did not receive until after January 1st. All income reported on 1099s are reported to the IRS, so when you file your taxes, you should report the full amount in Box 7. You can then make an adjustment to your income by reporting the extra amount as an “other expense” line item with an explanation of “1099 income not received.” If you make this adjustment, then you’ll need to make sure you add that income as “other income” the following year since it won’t be included in the 1099 for that tax year.

Even if you use a tax preparer to file your taxes, it’s important that you understand your numbers. The tax preparer won’t know that reimbursements are included in box 7 unless you know it and share that information. The same goes for any year end income discrepancies. It’s easy for the tax preparer to make the necessary adjustments, but you need to alert him/her to the fact that an adjustment is needed.

Please note – I am not a tax professional, but I did do my research on this topic before posting. If anyone would like my resources, please ask.